30+ subprime mortgages definition

Comparisons Trusted by 55000000. The Mutual Of Omaha Brand Has You Covered.

Securitization And Distressed Loan Renegotiation Evidence From The Subprime Mortgage Crisis Sciencedirect

Compare Lenders And Find Out Which One Suits You Best.

. Web In finance subprime lending also referred to as near-prime subpar non-prime and second-chance lending is the provision of loans to people in the United States who may. Web We show that estimates of the number of subprime originations are somewhat sensitive to which types of mortgages are categorized as subprime. Subprime mortgage loans the most common.

Web A subprime loan is a loan offered to individuals at an interest rate above prime who do not qualify for conventional loans. For Homeowners Age 61. Ad 5 Best Home Loan Lenders Compared Reviewed.

These loans are considered a driver of the. Web subprime lending the practice of extending credit to borrowers with low incomes or poor incomplete or nonexistent credit histories. Ad AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees.

Web According to the subprime mortgage definition the approximate down payment amount ranges from 25 to 35 of the loans sum. Such individuals have low income limited. Web The word subprime refers to the credit characteristics of individual borrowers.

From Insurance Needs To Reverse Mortgage Loans. Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. Web Subprime mortgages come with high interest rates and are usually given to borrowers with credit scores below 620.

Get A Free Information Kit. Ad Compare the Best Reverse Mortgage Lenders. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today.

Web Bonds consisting primarily of mortgages became known as mortgage-backed securities or MBSs which entitled their purchasers to a share of the interest and principal payments. Web A subprime lender is a lender that offers loans to borrowers at a subprime interest rate which is significantly higher than the typical prime rate. Web Subprime mortgages are home loans that may have higher closing costs down payments and interest rates as creditors are taking on more risk when they lend to borrowers with.

1 These loans give borrowers with poor credit. Web More often subprime mortgage loans are adjustable rate mortgages ARMs. A subprime mortgage is generally a loan that is meant to be offered to prospective.

Looking For Conventional Home Loan. Ad Let Our Specialists Help You Decide If A Reverse Mortgage Is Right For You. Web Additional loan options including extended loan terms exceeding 30 years interest-only payments and negative amortization Cons Higher interest rates which will lead to more.

For Homeowners Age 61. Lenders provide subprime loans to borrowers with credit issues and reserve prime loans. Web Subprime mortgages are home loans designed for and marketed to borrowers with lower credit scores and poor credit histories.

Turn A Portion Of Your Homes Equity Into Supplemental Cash With A Reverse Mortgage Loan.

What Is A Subprime Mortgage Credit Scores Interest Rates

What Happened To Subprime Auto Loans During The Covid 19 Pandemic Federal Reserve Bank Of Chicago

Is The Definition Of Market Value Outdated George Dell Sra Mai Asa Cre

Many Americans Overpay For Car Loans Subprime Loans Consumer Reports

What Is A Subprime Mortgage Your Credit Score Is Key

Subprime Mortgage Crisis Wikipedia

A Dynamic Analysis Of S P 500 Ftse 100 And Euro Stoxx 50 Indices Under Different Exchange Rates Plos One

What Is A Subprime Mortgage Experian

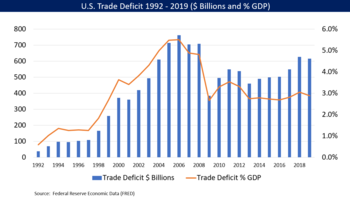

Subprime Mortgage Originations Annual Volume And Percent Of Total Download Scientific Diagram

Jpmorgan Chase Co Slide Presentation

Many Americans Overpay For Car Loans Subprime Loans Consumer Reports

Subprime Mortgage Definition Types How It Works

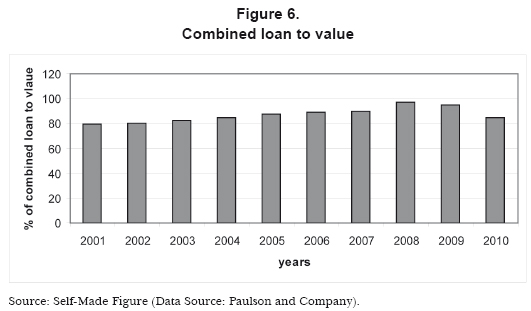

Financial Crisis 2007 2009 How Real Estate Bubble And Transparency And Accountability Issues Generated And Worsen The Crisis

Subprime Mortgage Crisis Wikipedia

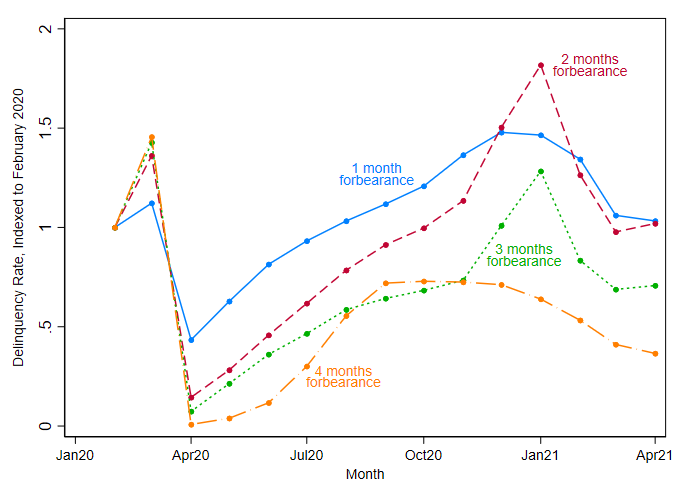

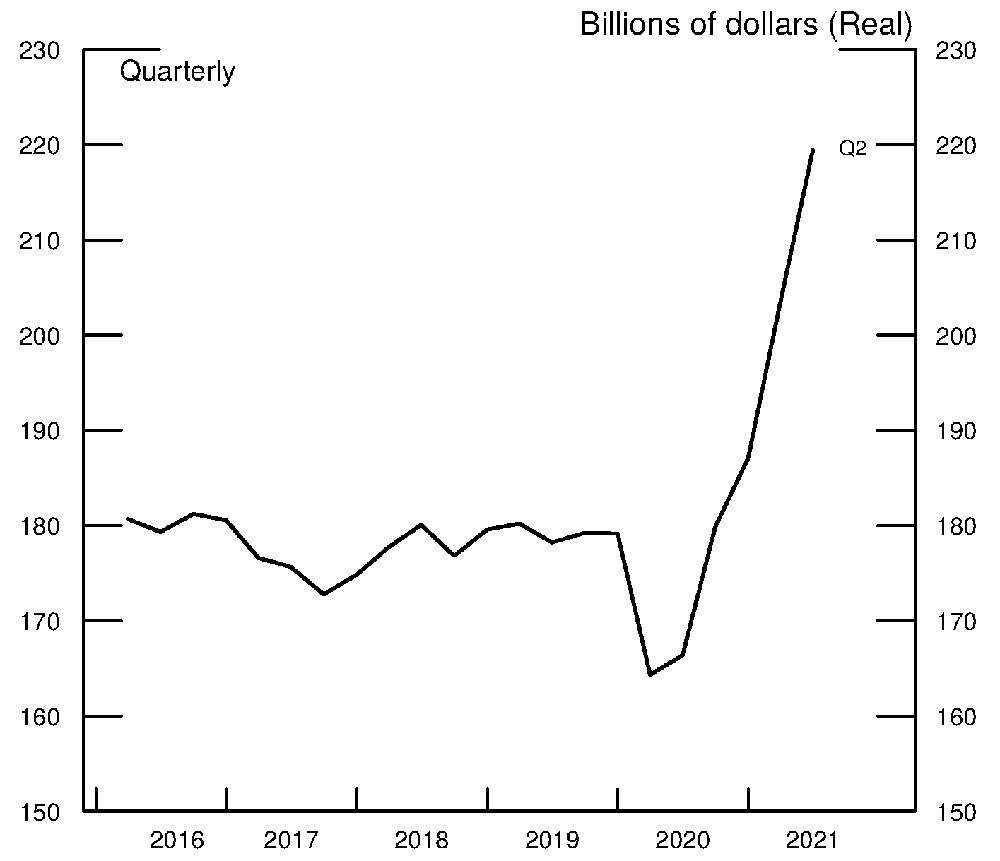

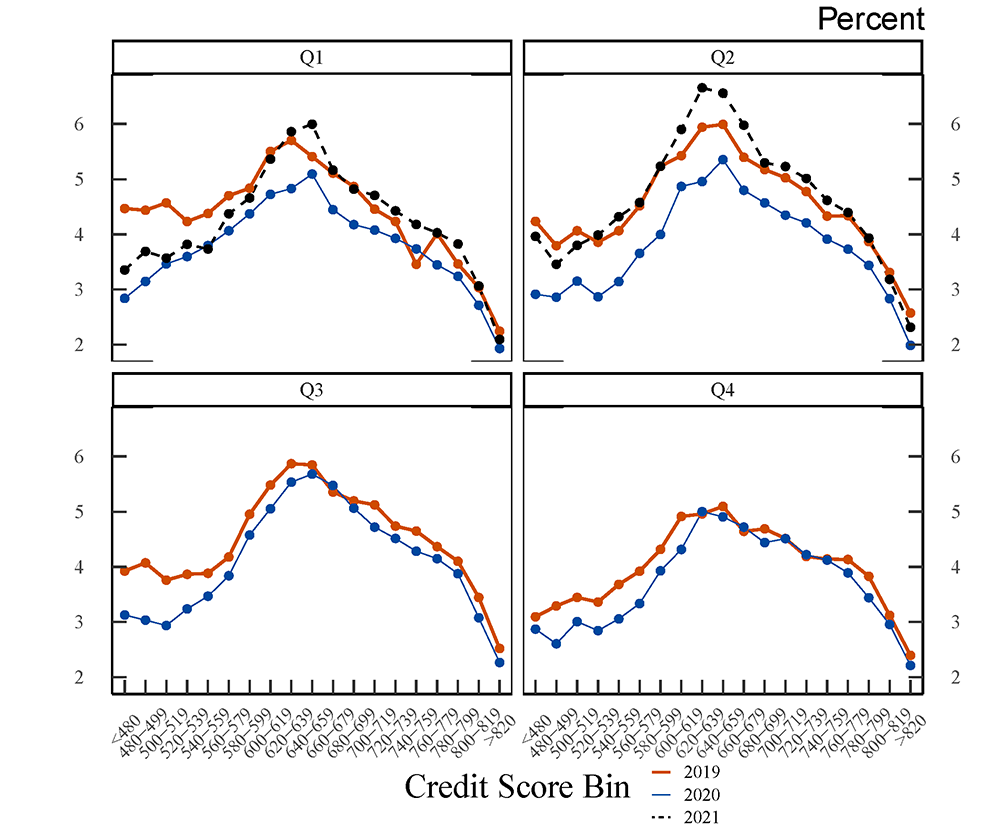

The Fed Delinquency Rates And The Missing Originations In The Auto Loan Market

Subprime Tentacles Of A Crisis Finance Development December 2007

The Fed Delinquency Rates And The Missing Originations In The Auto Loan Market